TrustAML-REALESTATE is Anti Money Laundering and Terrorist Financing(AML/CFT) solutions for Real Estate Companies. It is fully compatible with AML/CFT national and international standards and parameters. It is adjustable with the size of business, nature, organization, and core IT systems of the bank. Handovers systematic, classified, easily updatable rigorous customer due diligence (CDD) systems. It Provides a pool of data-base on a risk-based approach having a sufficient number of mandatory fields, enhanced fields, Maker checker verification, KYC to be improved, PEP list, negative list, under-monitoring list, FATCA list, convicted list, sanction list, under-monitoring list.

TrustAML-REALESTATE is Anti Money Laundering and Terrorist Financing(AML/CFT) solutions for Real Estate Companies. It is fully compatible with AML/CFT national and international standards and parameters. It is adjustable with the size of business, nature, organization, and core IT systems of the bank. Handovers systematic, classified, easily updatable rigorous customer due diligence (CDD) systems. It Provides a pool of data-base on a risk-based approach having a sufficient number of mandatory fields, enhanced fields, Maker checker verification, KYC to be improved, PEP list, negative list, under-monitoring list, FATCA list, convicted list, sanction list, under-monitoring list.

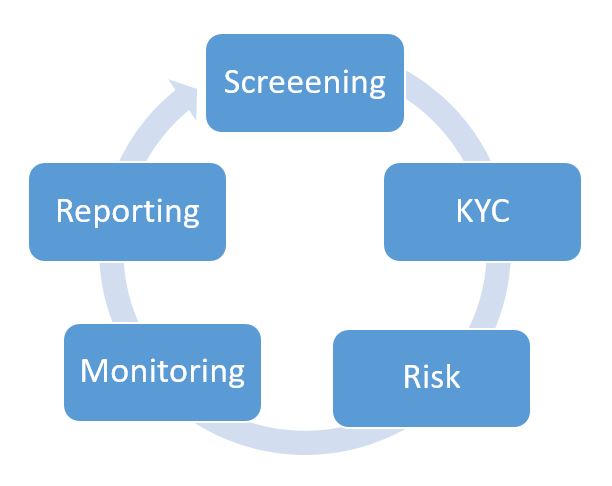

TrustAML covers all landscape of AML/CFT that a bank has to address the risk associated with ML/TF. It follows FATF guidance for a Risk-Based Approach in the business.

TrustAML has the capability of handling all aspects of the AML/CFT Ecosystem in your organization.

Screening

Screening

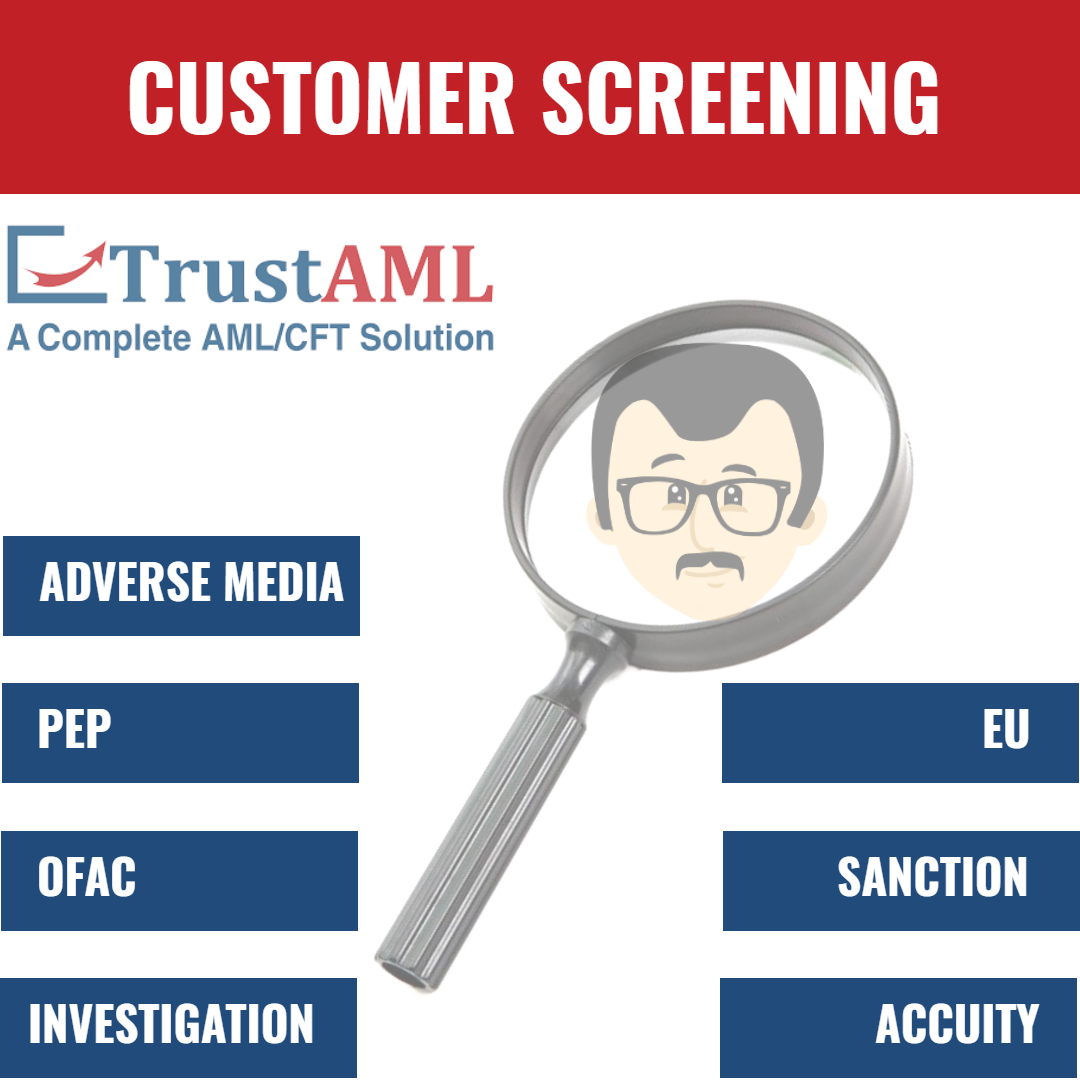

Screening is the process of dynamically comparing the data you hold on customers, prospective customers, suppliers, and counterparties against the data that is held within external data sources including sanctions lists, watch lists, PEP lists, and adverse media, for risk management purposes. TrustAML fully follows the recommendations laid down by FATF and global AML/CFT Law enforcement agencies guidelines in customer identification and acceptance policies. The system has a feature to screen the customers while onboarding them and on a periodic basis whenever the watch list is updated into the system. Our system supports screening against the sanction, high-risk profiles, existing customers, third party data like Accuity, EU, OFAC, HMT, previously screened data, and other lists as per internal norms and BFIs AML policies and procedures. It supports complete work-flow from branch to compliance officers.

Screening is the process of dynamically comparing the data you hold on customers, prospective customers, suppliers, and counterparties against the data that is held within external data sources including sanctions lists, watch lists, PEP lists, and adverse media, for risk management purposes. TrustAML fully follows the recommendations laid down by FATF and global AML/CFT Law enforcement agencies guidelines in customer identification and acceptance policies. The system has a feature to screen the customers while onboarding them and on a periodic basis whenever the watch list is updated into the system. Our system supports screening against the sanction, high-risk profiles, existing customers, third party data like Accuity, EU, OFAC, HMT, previously screened data, and other lists as per internal norms and BFIs AML policies and procedures. It supports complete work-flow from branch to compliance officers.

Know your Customer(KYC)

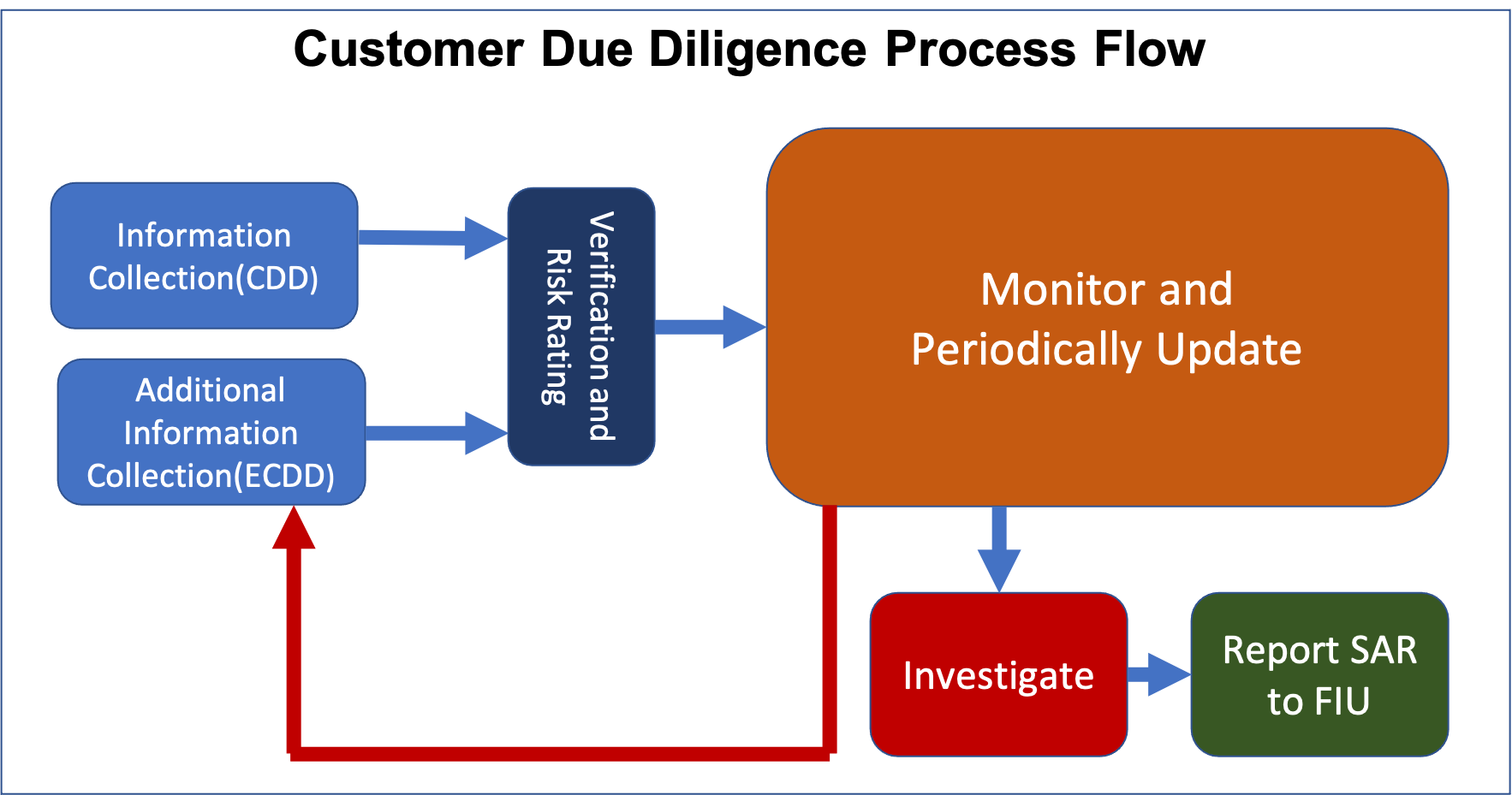

Manage complete KYC (CDD/ ECDD) workflow by collecting customer’s information, cross-checking with PEP, negative and other lists, selecting different risk measures, uploading support documents, providing easy update options, and interfacing with core banking solutions and current data. The module has a field for customers and all its related parties’ information.

Manage complete KYC (CDD/ ECDD) workflow by collecting customer’s information, cross-checking with PEP, negative and other lists, selecting different risk measures, uploading support documents, providing easy update options, and interfacing with core banking solutions and current data. The module has a field for customers and all its related parties’ information.

KYC extended version also supports the fingerprint enrolment and verification integrating with the TrustAML Cross check module. The module also supports the integration of the camera to take photos. In this module bank’s employee can verify complete KYC details of the customer by taking their biometrics. Multiple fingerprints of single customers can be set up for a higher match level. The module can further be integrated with the core banking system in order to verify customers at the transactional level.

Risk Profiling

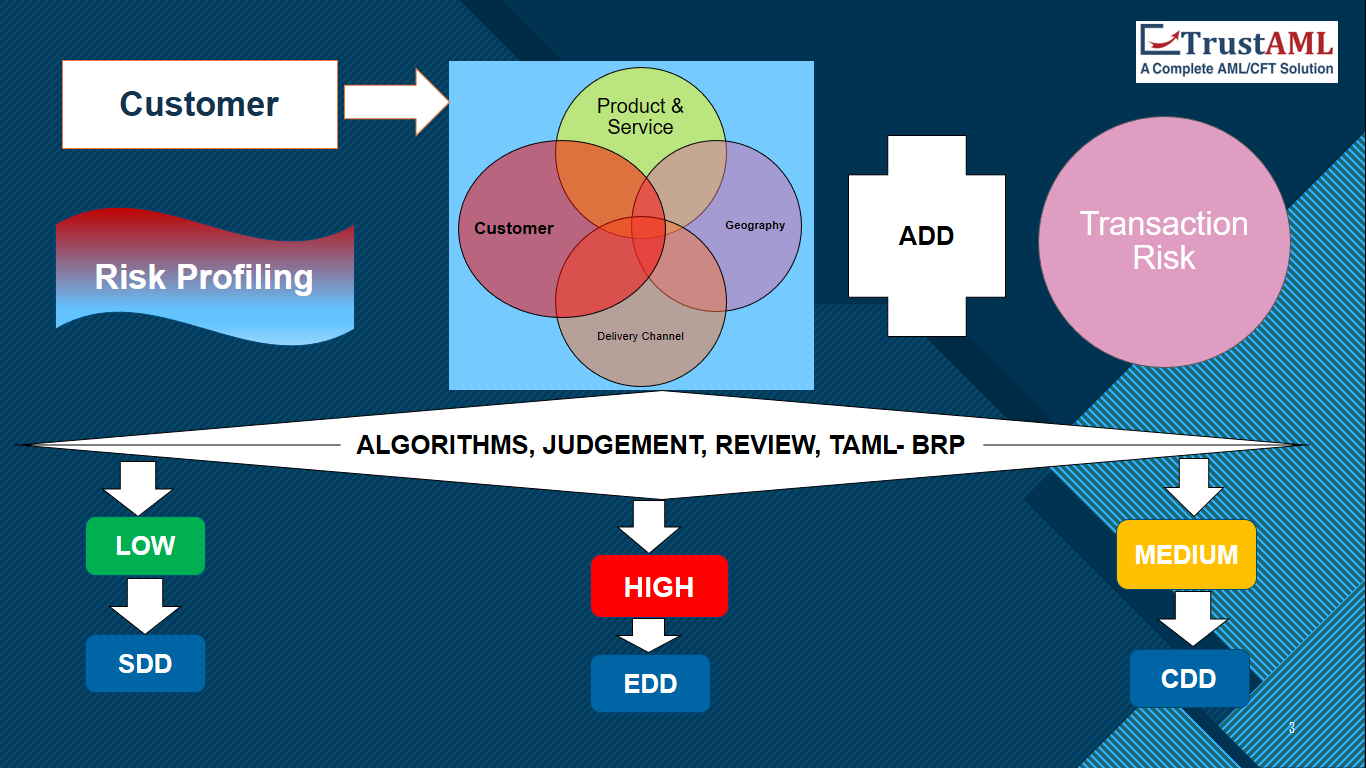

TrustAML follows the complete Risk-Based Approach Method in order to identify assess and understand MLTF risk associated with the customer, products, services transactions, geography, and delivery channels. Get consolidated reports on different levels of risks, trends, and practices enabling the business to take appropriate risk-based on control measures. In addition to the module to calculate the risk values, TrustAML also helps BFIs consulting them to identify the risk values for the different variables on the basis of which risk is calculated. Provision to upload risk value to high risk for the customers which are exceptional and need to be dealt with separately apart from the way covered by a scientific Risk-Based Approach. TrustAML also provides batch risk profiling to customers on-demand as well as on a quarterly basis.

TrustAML follows the complete Risk-Based Approach Method in order to identify assess and understand MLTF risk associated with the customer, products, services transactions, geography, and delivery channels. Get consolidated reports on different levels of risks, trends, and practices enabling the business to take appropriate risk-based on control measures. In addition to the module to calculate the risk values, TrustAML also helps BFIs consulting them to identify the risk values for the different variables on the basis of which risk is calculated. Provision to upload risk value to high risk for the customers which are exceptional and need to be dealt with separately apart from the way covered by a scientific Risk-Based Approach. TrustAML also provides batch risk profiling to customers on-demand as well as on a quarterly basis.

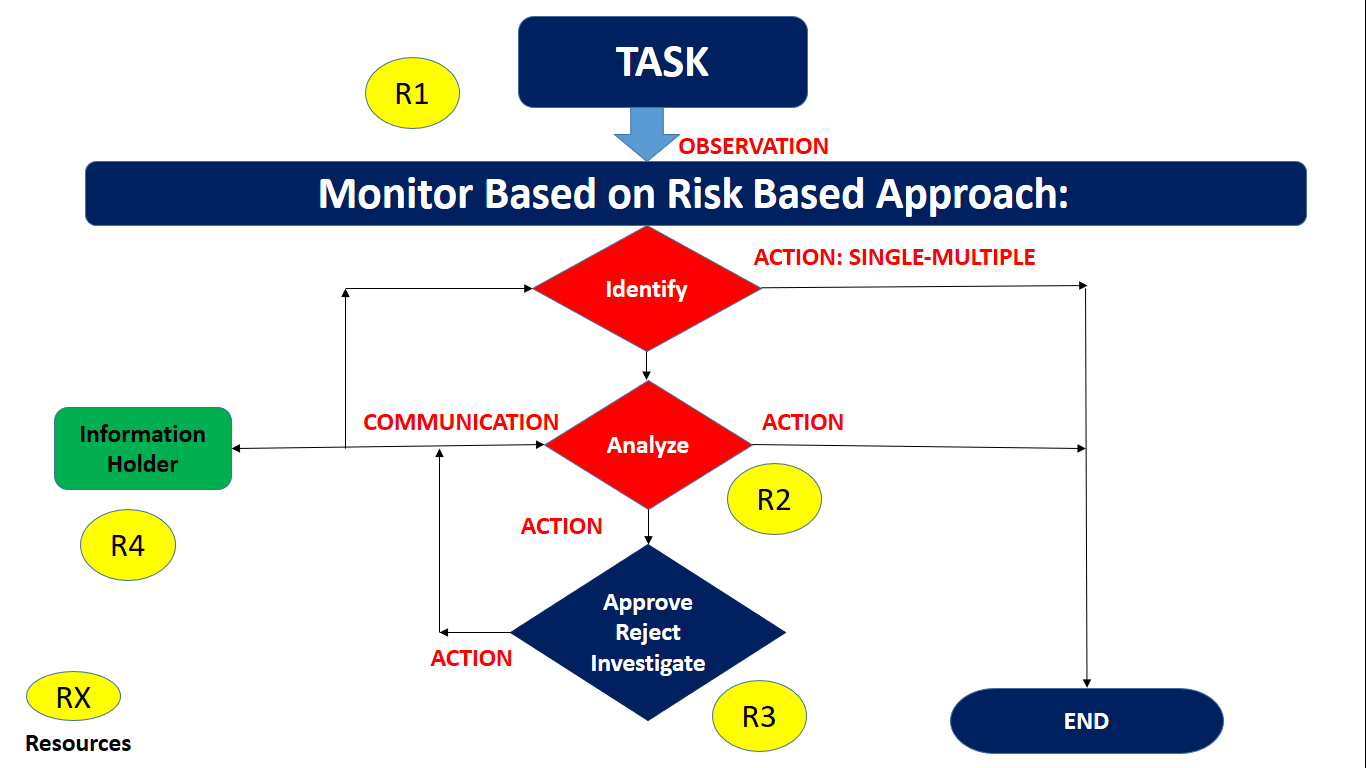

Monitoring

Get reported about unusual, suspicious and fraudulent transactions with TrsutMon by comparing and contrasting transactions with customer profile, searching and linking into the list, analyzing transactions by using predefined indicators in relation to business, products, customer, geography, delivery modalities, etc. Get alerts of unusual activities and high-risk profiles including review of reports. The monitoring module can work on the different modality of real-time monitoring/daily monitoring, weekly monitoring without affecting the performance of core banking software at your organization. The generated flags can be managed by escalating to higher authorities for further analysis and approval for reporting.

Get reported about unusual, suspicious and fraudulent transactions with TrsutMon by comparing and contrasting transactions with customer profile, searching and linking into the list, analyzing transactions by using predefined indicators in relation to business, products, customer, geography, delivery modalities, etc. Get alerts of unusual activities and high-risk profiles including review of reports. The monitoring module can work on the different modality of real-time monitoring/daily monitoring, weekly monitoring without affecting the performance of core banking software at your organization. The generated flags can be managed by escalating to higher authorities for further analysis and approval for reporting.

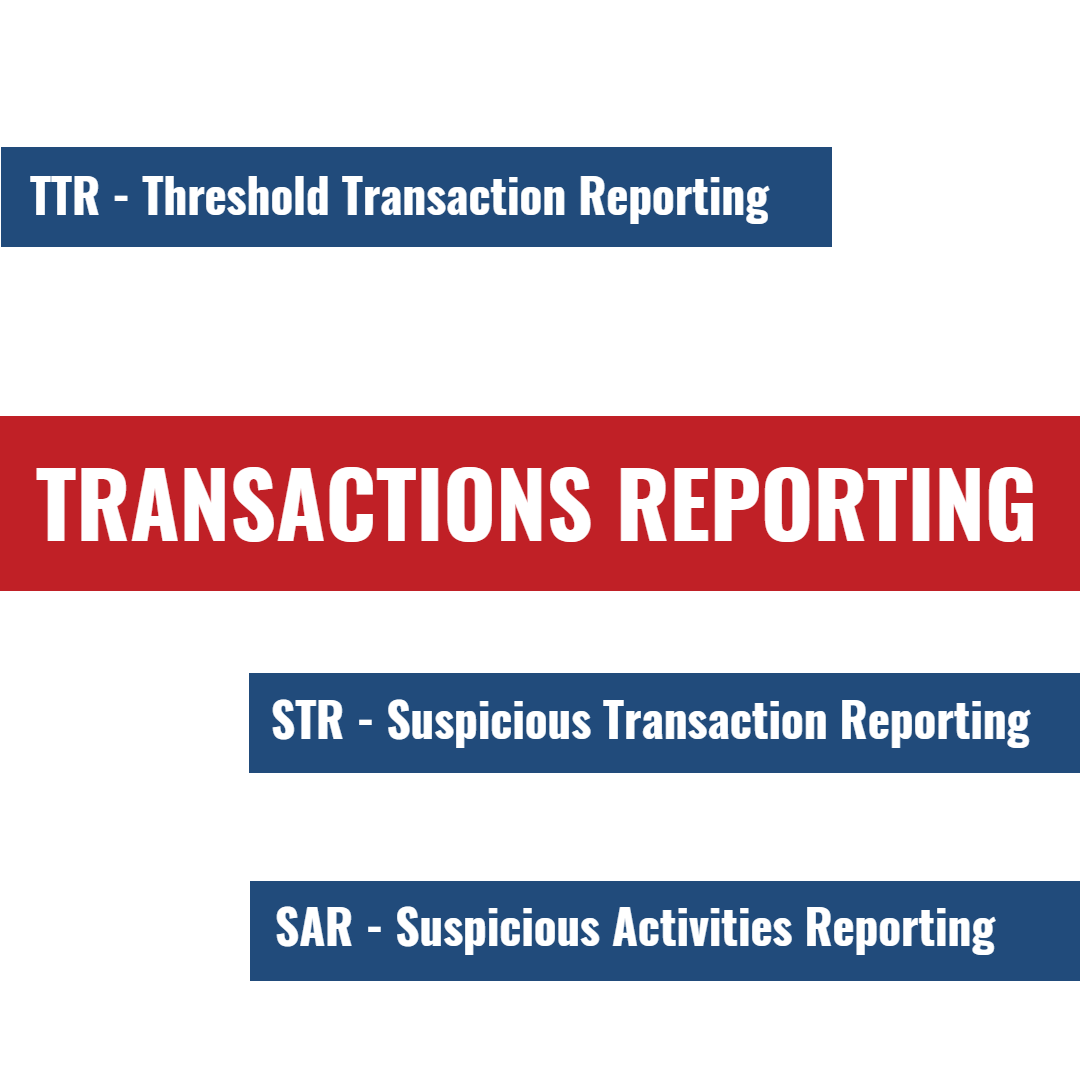

Reporting

TrustAML provides a dynamic user interface and helps compliance level users on reporting the accounts and transactions breaching a threshold limit set by Regulator. Our module also takes care of conductors and drawees of different transactions happening over categories like cash, remittance, and foreign exchange.

TrustAML provides a dynamic user interface and helps compliance level users on reporting the accounts and transactions breaching a threshold limit set by Regulator. Our module also takes care of conductors and drawees of different transactions happening over categories like cash, remittance, and foreign exchange.

TrustAML gives a large variety of scenarios to check the transactions regarding any suspicious activities. TrustAMLL is a software check for different electronic transactions like in bank account to account transfer as well as interbank cheque clearing services. TrustAML’s suspicious transaction reporting also incorporates dynamic KYC analysis and rigid risk categorization. The system also enables the required reporting modules for Management, Regulator and fully compatible with goAML system of the Financial Information Unit (FIU)-Nepal.